This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

In light of the growing array of environmental and social challenges across the globe, it is more important than ever that financial institutions take a proactive and responsible approach to sustainability. The consequences of overlooking or neglecting these issues can be severe not only for the planet but also for financial actors that can miss financial risks arising from the escalating impacts of climate change and environmental crisis. The financial sector is also instrumental in funnelling resources towards a sustainable economy.

Supported by the ECCJ and 12 organisations from across the EU, the report’s findings underscore that while the financial institutions in the EU have nearly four times more financial assets than non-financial companies, many policymakers are pushing hard to exclude due diligence requirements for financial activities in the negotiations on the upcoming law.

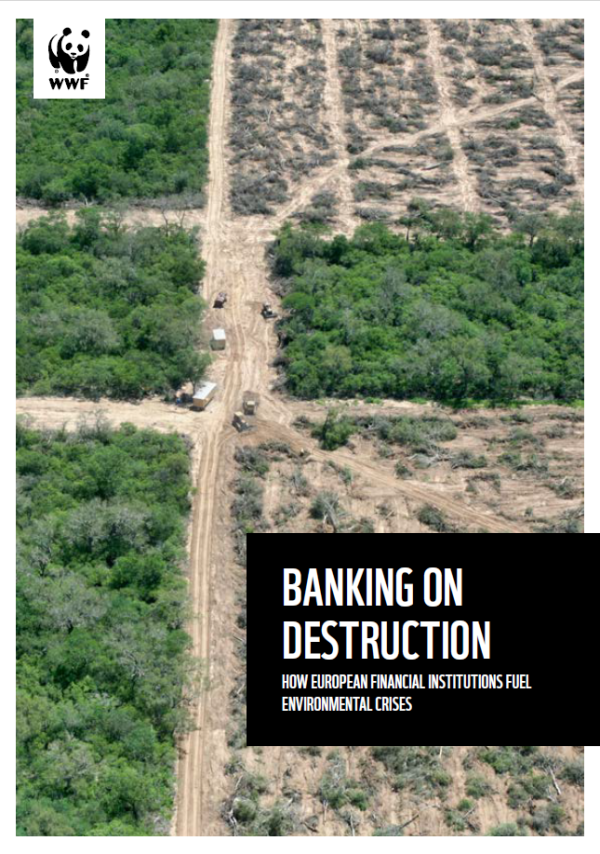

This briefing showcases EU financial institutions’ involvement in driving environmental and human rights-related harm. It highlights how a robust sustainability due diligence law could and should minimise such impacts and induce more responsible financial practices, safeguarding both the financial sector’s resilience and the planet’s well-being. The report zooms into three cases of harmful finance: (1) Paraguay’s deforestation crisis; (2) environmental pollution and public health crisis in Colombia; (3) harm to coastal ecosystems and communities in the Philippines.

Sustainability Due Diligence law could ensure more informed and responsible financial practices

Financial institutions in the EU have been involved in driving environmental and human rights-related harm, but the upcoming Corporate Sustainability Due Diligence Directive could minimise such impacts.

The EU’s upcoming Corporate Sustainability Due Diligence Directive (CSDDD) can provide the financial sector with a legal framework that fosters more responsible financial practices. By requiring financial institutions to identify and mitigate the social and environmental risks and harms in their financial decisions and portfolios, this Directive could limit harmful

financial flows on the one hand, and ensure more effective management of sustainability-related financial risks on the

other. Such a requirement is considered necessary by many stakeholders, including progressive investor groups,

banking associations, pension funds, the United Nations in its Guiding Principles and the OECD in its general and investor-specific guidelines.

Although the Directive aims to establish a common standard for the EU that would cover the entire economy, it is still unclear how the law would apply to the financial sector, as the negotiators’ views on key elements in the final negotiation stage differ. For instance, should financial institutions be required to consider sustainability-related risks and harms in their financial decisions and portfolios at all? And if so, should the requirement be for all financial services and activities, including lending, insuring and investing? Or should financial firms conduct sustainability due diligence regularly throughout the financing cycle, or just once before the financing decision? Critically, not requiring financial firms to consider sustainability factors in some or all financial activities, or throughout the financing cycle, would allow them to overlook sustainability harms and cause them to miss financial, physical and reputational risks.